How To Open An FAB Account Online In UAE? – Personal Or Bussiness Account Opening

Opening a bank account with First Abu Dhabi Bank (FAB) is a straight forward process that offers access to a wide range of banking services. Whether you are a resident or a non-resident of the UAE, FAB provides different account options for various needs, whether you’re looking for a basic savings account, a current account for everyday transactions, or a specialized account for business or investment purposes.

You can easily open an account through two methods; online registration via the mobile app, or by visiting a branch in person.

Follow the steps below to open your FAB account easily!

Why Open an FAB Account?

First Abu Dhabi Bank is one of the largest and most reliable banks in the UAE. By choosing to open an account with FAB, you get access to a variety of benefits:

- Wide Range of Accounts: FAB offers savings, current, and fixed deposit accounts to suit different financial goals.

- Convenient Digital Banking: Enjoy the ease of online banking and mobile app access to manage your finances anytime, anywhere.

- Accessibility: With branches across the UAE, including ATM networks and international banking, FAB ensures you have access to your funds at all times.

- Competitive Offers: FAB often provides special offers like no account maintenance fees for the first few months, higher interest rates for fixed deposits, and more.

Types of FAB Accounts in UAE

FAB offers several types of accounts, each designed to cater to specific financial needs. Below are the most common types:

1. Savings Account

A savings account with FAB allows you to earn money on your balance while keeping your funds easily accessible.

- Benefits:

- Competitive interest rates

- Easy transfers and withdrawals

- No monthly maintenance fees (depending on account type)

- Minimum Balance Requirements: Typically, savings accounts require a minimum balance of AED 3,000. To verify your balance, you can check the FAB Balance Check. Some specific savings accounts may have higher requirements.

2. Current Account

A current account is ideal for individuals and businesses that need to perform regular transactions, such as payments, deposits, and withdrawals.

- Benefits:

- Loan protection (based on eligibility)

- No earnings, but free transactions are available

- Special offers for salary transfers and business banking

It’s ideal for people who need access to their funds regularly for everyday transactions.

3. Fixed Deposit Account

A fixed deposit account allows you to place a specific sum of money for a fixed period, earning higher rewards than a savings account.

- Benefits:

- Higher interest rates

- Flexible durations ranging from 1 month to 5 years

- Guaranteed returns

Eligibility Requirements for FAB Bank Account Opening

To open an account with FAB, you must meet certain eligibility requirements, which vary based on your residency status:

For UAE Residents

For Non-Residents

How To Open An FAB Account?

FAB offers two ways to open an account:

- Online

- In-person at a Branch

A step-by-step guide for both methods is given below!

FAB Bank Online Account Opening

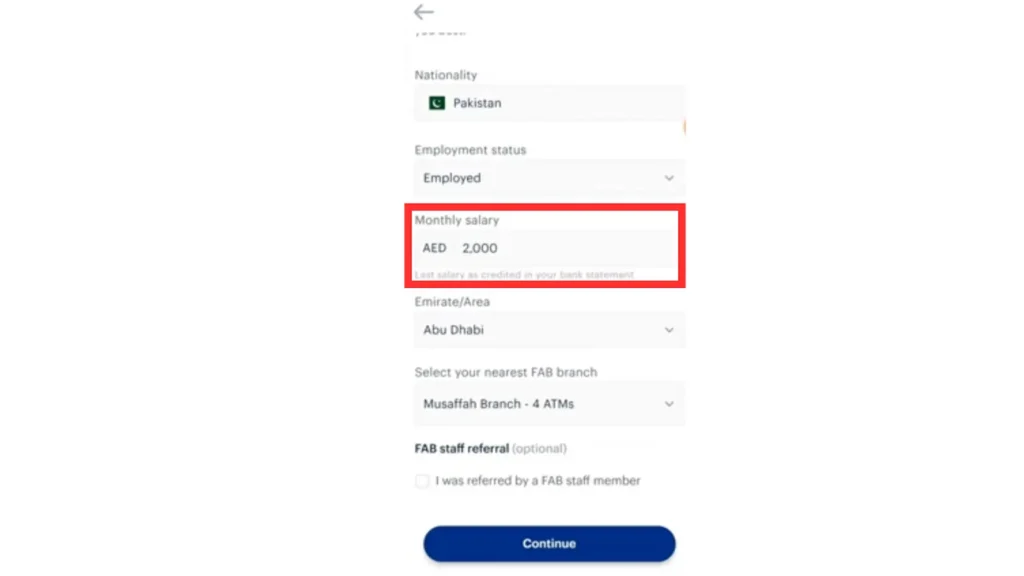

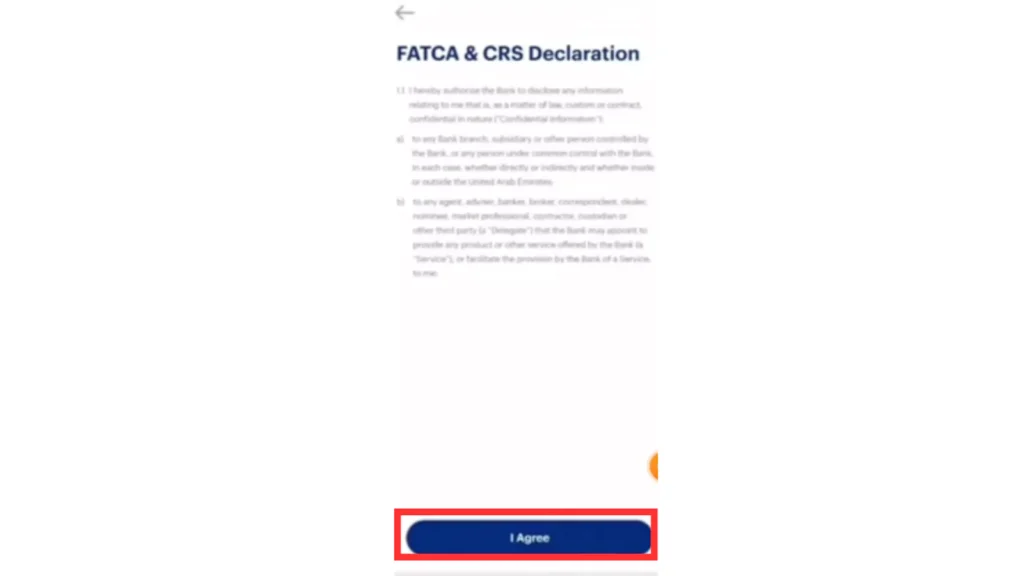

FAB offers a simple and quick process to open an account online through their mobile app:

Choose Your Account

|

Feature |

Personal Current Account |

Business Current Account |

Personal Savings Account |

Children’s Savings Account |

|

Minimum Balance |

AED 3,000 |

AED 10,000 |

AED 3,000 |

AED 500 |

|

Monthly Fee |

AED 25 |

AED 75 |

AED 25 |

AED 10 |

|

Interest Rate |

0% |

0% |

0.75% p.a. |

1.00% p.a. |

|

Debit Card |

Free |

Free |

Free |

Not available |

|

Cheque Book |

AED 25 |

AED 25 |

Not available |

Not available |

|

Online Banking |

Free |

Free |

Free |

Free |

|

ATM Withdrawal Fee |

Free (FAB ATMs) |

Free (FAB ATMs) |

Free (FAB ATMs) |

Free (FAB ATMs) |

|

International Transfer Fee |

AED 50 |

AED 50 |

AED 50 |

AED 50 |

Note: To avoid any charges, you must maintain a minimum salary of AED 3,000 in your savings account. If this balance is not maintained, a fee of AED 25–26 will be deducted monthly.

Visiting an FAB Branch

If you prefer to open your account in person, follow these steps:

FAB Account Opening Fee or Initial Deposit

Processing Time to Open a FAB Account

Processing time to open a FAB account depends on the type of account.

Conclusion

Opening an account with First Abu Dhabi Bank (FAB) in the UAE is a convenient and rewarding process, whether you are a resident or a non-resident. With a variety of account options and simple steps for opening an account, FAB ensures a seamless banking experience.

Whether you’re looking to save, manage daily transactions, or invest in fixed deposits, FAB offers all the resources you need to meet your financial goals.

3 Comments