Ratibi Card Salary Check, Balance Check 2025 – PPC Inquiry Portal

Having trouble checking your Ratibi Card salary balance or not sure what else the Ratibi card can do? You’re not alone, many workers feel like you. But don’t worry, the answer is easy and simple. You can check Ratibi Card salary from multiple easy methods and FAB Ratibi card is more than just a way to get your salary. It allows you to see your salary, sends free SMS updates, and even offers early salary access. You can also use this card to check your balance online, take out cash from ATMs, and use the Payit app for digital payments.

One of the key features of the Ratibi Card is that it doesn’t require a bank account, making it accessible for all.

Knowing how to check your Ratibi card balance is essential to manage your finances effectively, ensure timely salary deposits, and avoid potential financial problems.

What is the Ratibi Card?

Ratibi card is a salary payment solution for Employers of the United Arab Emirates. In this digital era, through Ratibi Card Employers can pay salaries to their employees digitally without any local bank accounts.

FAB’s Ratibi Card is a prepaid card made for workers earning up to AED 5,000. It lets employees get paid even if they don’t have a bank account. The card can be used for ATM withdrawals, shopping, and online payments. You can also check your balance online easily using the Payit app or by using an ATM.

Why is Salary Checking Important?

Regularly checking your Ratibi card balance is crucial for several reasons:

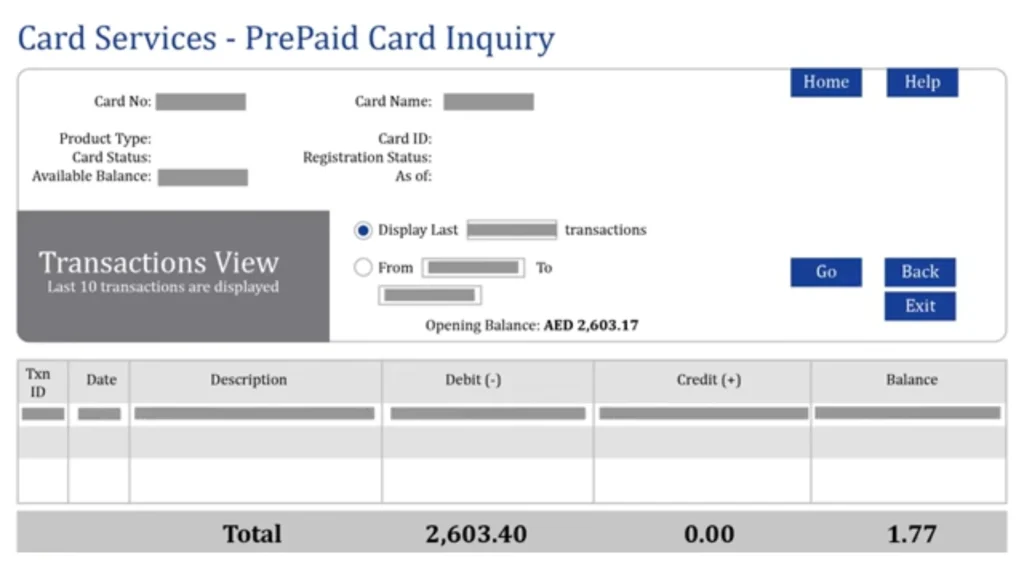

How to Check Ratibi Card Salary?

Ratibi offers several convenient methods to check your Ratibi card salary balance. This methods include:

- Using Official Website

- Through Mobile App

- Via Sending SMS

- Via FAB Customer Care

- Check Via Payit App

- Ratibi Balance Check Via FAB Branch Visit

Ratibi Card Salary Check Using Official Website

For users who prefer using a web browser, you can check your Ratibi salary card balance by following the steps given below:

That’s how you can easily check your ratibi salary balance.

Ratibi Card Salary Check Through Mobile App

The FAB mobile app is a convenient tool for managing your Ratibi salary card. Here’s how:

Ratibi Balance Check Via SMS

To check your Ratibi card balance through SMS, follow these steps:

Ratibi Card Salary Check Using the Payit Mobile App

You can also check your Ratibi Card salary through Payit Mobile App by following these simple steps.

Step 1: Download the Payit App

From the Google Play store, download the official Payit App and install it on your mobile phone.

Step 2: Select the Ratibi Cardholder

After installing the Payit App, open it and select the “Ratibi Card Holder” option.

Step 3: Scan Emirates ID

Scan your Emirates ID and you will see your personal details. Confirm these details and continue.

Step 4: Enter Ratibi Card Details

Now write your Ratibi Card details like ID of Ratibi Card and last two digits to continue further.

Step 5: Mobile Number

Enter your personal mobile number which is registered with the Ratibi card. After this verify your mobile number 6-digit code sent on your same number.

Step 6: Create your PIN

Generate your 4 digit PIN to protect your account and finish the registration process.

Step 7: Check your Salary Balance

After you register with Payit App, you can check your balance anytime from the Payit App.

Ratibi Card Salary Check Using ATM

You can also check your Salary in Ratibi Card using the ATM machine.

Ratibi Balance Check Via FAB Customer Care

Ratibi card users can check their card balance through FAB customer care:

Ratibi Card Eligibility Criteria

Below are the eligibility requirements to apply for a Ratibi card:

How to Apply for a Ratibi Card?

Applying for a Ratibi card is simple and convenient. You can do this by using three different methods:

- Ratibi Application

- iBanking Application

- By visiting a Ratibi Branch

Ratibi Application

iBanking Application

By visiting a Ratibi Branch

Application Form for Ratibi Card PDF

Benefits of the Ratibi Card

The Ratibi Card, offered by First Abu Dhabi Bank (FAB), provides several advantages for employees in the UAE. Whether you are a worker without a traditional bank account or an employer looking for a reliable payroll solution, the Ratibi Card has multiple benefits:

Basic Benefits

Employer Benefits

Insurance Benefits

Safe and Convenient Benefits

Common Issues & Troubleshooting

Salary Issues: If your salary is not credited then immediately contact your employer or call FAB customer support to resolve your issue.

ATM Issues: First of all make sure your ATM is part of a Visa card or Mastercard. If your ATM is no working contact with customer support or call the helpline number given on your card.

Forgot PIN: Reset your PIN at a FAB ATM or call customer support to assist you.

Ratibi Card vs Traditional Bank Account

| Ratibi Card | Traditional Bank Account |

| No bank account required | Bank account required |

| Salary Payment is Preloaded onto the card | Salary Payment is Deposited into an account |

| ATM Withdrawals available | ATM Withdrawals available |

| Limited Online Banking | Full access of Online Banking |

| Limited Transaction History | Full records available of Transaction History |

Conclusion

The Ratibi card is a convenient solution for salary payment in the UAE, offering convenience, security, and ease of use. By knowing how to check your salary balance through various methods like, online banking, and mobile app, you can manage your funds effectively.

Whether you’re new to the Ratibi system or a long-time user, staying informed about its features and functionalities ensures a seamless experience.